-

8 OILS

MONTHLY Feb 21

Continuing Woes in Palm Oil Are Keeping World Supplies Still Tight

Dependence on soya oil increases further. Suspension of admixture increase in Brazil improves soya oil export supplies somewhat.....

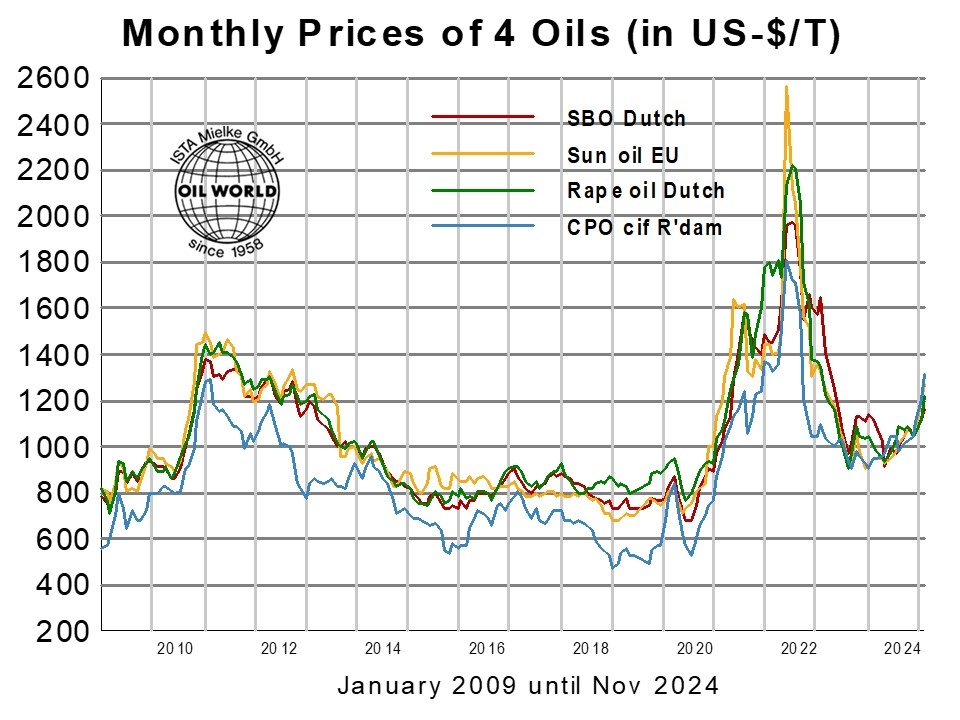

Prices of palm oil and the major seed oils increased sharply during the past 12 months. The price averages registered in Oct/Feb 2024/25 were up 33–37% on the year for crude and refined palm oils, by 17-19% for rapeseed oil in Europe and soya oil in South America and more than 30% for sunflower oil. This contrasted with a 30% decline of gas oil futures on average of Oct/Jan. These developments have prompted different political reactions .... Read about the latest OIL WORLD supply & demand estimates in the MONTHLY... -

Usage of Soya Meal Seen Rising by 16 Mn T in 2024/25

MONTHLY Feb 21

Argentine Crop Scare Providing Support

Record soybean crushings and attractive prices boosted world soya meal exports by 4.9 Mn T in Oct/Jan 2024/25

Comparatively low soya meal prices and partly insufficient supplies of other feed ingredients boosted world soya meal consumption in the first four months of the 2024/25 season. We tentatively forecast total soya meal usage to reach a record 275.3 Mn T this season ... More details in the MONTHLY...

-

Oils & Fats

WEEKLY Feb 14

Palm Oil Has Lost Market Share Due to Insufficient Growth in Production

Palm oil has lost market share due to insufficient growth in production. The average annual growth of world palm oil production slowed significantly to only 0.6% in the five years ended 2024 compared with an average increase of 5.3% per annum in the five years until 2019.

Palm oil is still by far the most important vegetable oil but its share of world production of 17 oils & fats dropped from 32% to 30% in the five years to 2024. ....

-

PALM OIL

WEEKLY Feb 7

World Supplies of Palm Oil Still Tight in Jan/March 2025

World production of palm oil is forecast to recover in 2025 under the lead of Indonesia, following a decline by 2.5 Mn T last year. Supplies are seen remaining tight in Jan/March 2025....

Consumers in the importing countries will become more dependent on palm oil in April/Sept 2025 due to the prospective sharp declines anticipated for world production and exports of sunflower oil and rapeseed oil....

-

10 OILSEEDS

WEEKLY Jan 31

Deviating Trends in Crushings of Soybeans, Sunflowerseed and Rapeseed

In Jan/Aug 2025 world production of 10 seed oils is expected to decline by almost 0.9 Mn T on the year, reversing the sizable increase registered in Jan/Dec 2024 and raising global import dependence on palm oil....

Our markets will be influenced by some major supply changes in Jan/Aug 2025, partly contrasting with the developments registered in preceding months. We discuss the major changes in respect to oilseed crushings as well as production of vegetable oils and oilmeals in the Weekly of Jan 31....

-

EU-27

WEEKLY Jan 17

Import Demand for Rapeseed to Stay Elevated in 2025/26

European rapeseed production is likely to stay below potential in 2025, following lower than initially expected winter rapeseed plantings in key producing countries....

We tentatively forecast EU-27 rapeseed production to recover to 19.1 Mn T in 2025, up 2.2 Mn T from a year earlier but still trailing the crops of 20.2 Mn T and 19.6 Mn T in the preceding two seasons....

-

PALM OIL

WEEKLY Jan 10

Exports Diminish to 8-Year Low

World exports of palm oil declined by approximately 1.0 Mn T on the year to 12.7 Mn T in Sept/Nov 2024, an 8-year low. Indonesian exports alone plummeted by 1.3 Mn T, while Thailand and Central America recorded more moderate reductions, which were only partly offset by higher shipments from Malaysia.

Consumers in importing countries switched to more attractively priced other edible oils, primarily soya oil, in response to the appreciation of prices and reduced export supplies of palm oil...

--- World Market Prices in US-$/T ---

--- World Market Prices in US-$/T ---

-

- 1088 Ap/Mr

- Feb 27

- Palm olein RBD, fob Mal

-

- 565 Ap/My

- Feb 27

- Rapeseed, Europe, cif Hamburg

-

- 1039 Ap

- Feb 27

- Soya oil, fob Arg

-

- 323 Ap

- Feb 27

- Soya Meal, fob Arg