-

GROUNDNUTS

WEEKLY Mar 21

Large Surplus Shaping Up in Groundnut Market

The markets of groundnuts and products will be characterized by ample to burdensome supplies in coming months, exerting price pressure. Record crops will be harvested both in Argentina and Brazil this year, coming on top of larger production in the USA and India....

World production is seen increasing to a new high of 36.4 Mn T in 2024/25 (shelled) implying an increase of 1.5 Mn T from last season...

-

LINSEED & FLAXSEED

WEEKLY Mar 14

EU Linseed Crushings Set to Decline Sharply in 2024/25

EU linseed crushings are seen falling to a 12-year low of only around 0.55 Mn T in Aug/July 2024/25), reducing output of linseed oil and expellers correspondingly. ....

EU crushers heavily depend on imports owing to insufficient domestic linseed production, with an import dependency of more than 90% on average of the 10 years to 2023/24. Trade restrictions on Russia and diminishing export supplies in Kazakhstan, viz. the two largest suppliers for the EU crush industry, have pushed EU linseed prices to a 12-month high....Latest OIL WORLD estimates in the WEEKLY...

-

CANADA

WEEKLY Mar 14

Canola Disposals Set to Decline

Escalating trade disputes with Canada’s two largest trading partners, viz. China and the US, will keep canola disposals sharply below potential in Mar/July 2025. China’s announcement of 100% import duties on Canadian canola oil and meal from March 20 onward pushed nearby canola futures (May position) to a three-month low....

While relatively tight world export supplies of vegetable oils should make it rather easy to revive import demand for Canadian canola oil in countries other than China and the US in coming months, the situation in meal is more complex....

-

INDIA

WEEKLY Mar 7

Imports Heavily Tilted from Palm Oil to Seed Oils this Season

Palm oil stocks in India plunged by roughly 0.8 Mn T in the past three months to less than 1.2 Mn T according to OIL WORLD estimates. Indian palm oil imports were clearly lower than consumption of late, enforcing a depletion of inventories...

The recent slowdown of veg. oil imports has been cushioned by relatively large vegetable oil stocks accumulated in India by the end of November 2024, which could be reduced since. However, the rapid depletion of stocks will necessitate more active purchases soon...

-

U.S.A.

WEEKLY Mar 7

Net Imports of Oils & Fats Down Sharply

The severe decline in US biodiesel production resulted in an at least temporary oversupply of soya oil on the domestic demand, reducing US prices to and even partly below the world market. While this is raising demand for US soya oil it also reduces margins for US importers, which will only be reflected in the official trade numbers with a time lag...

Combined US net imports of 17 oils & fats and tallow plummeted to only 0.56 Mn T in Jan (down 36% from a year earlier)....

-

PALM OIL

WEEKLY Feb 28

Palm Oil Production Problems

Higher yields and acreage expansion are needed to raise world palm oil production sufficiently in the years ahead. The loss of growth dynamics in palm oil output - primarily during the past five years - has greatly impacted global markets of all oils & fats...

The average annual growth in world palm oil production slowed down significantly to only 0.6% in the five years ended 2024 compared with an average increase of 5.3% in the five years until 2019... More details in the WEEKLY...

-

8 OILS

MONTHLY Feb 21

Continuing Woes in Palm Oil Are Keeping World Supplies Still Tight

Dependence on soya oil increases further. Suspension of admixture increase in Brazil improves soya oil export supplies somewhat.....

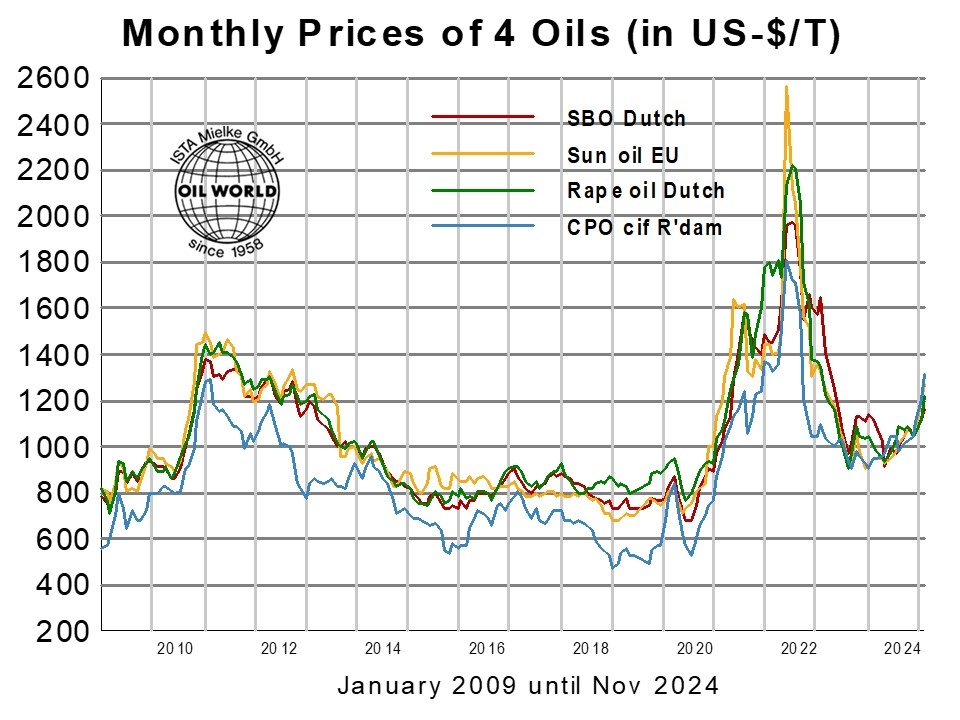

Prices of palm oil and the major seed oils increased sharply during the past 12 months. The price averages registered in Oct/Feb 2024/25 were up 33–37% on the year for crude and refined palm oils, by 17-19% for rapeseed oil in Europe and soya oil in South America and more than 30% for sunflower oil. This contrasted with a 30% decline of gas oil futures on average of Oct/Jan. These developments have prompted different political reactions .... Read about the latest OIL WORLD supply & demand estimates in the MONTHLY...

--- World Market Prices in US-$/T ---

--- World Market Prices in US-$/T ---

-

- 1120 Ap

- Mar 20

- Palm olein RBD, fob Mal

-

- 533 My

- Mar 20

- Rapeseed, Europe, cif Hamburg

-

- 988 Ap

- Mar 20

- Soya oil, fob Arg

-

- 1160

- Mar 20

- Crude Palm Oil, fob Indo