-

10 OILSEEDS

MONTHLY Mar 28

Global Soybean Production Surplus This Season Despite Some Crop Losses

World soybean production is now estimated at 416.0 Mn T this season, 1.4 Mn T below a month earlier but a new high and 20.5 Mn T above the previous record registered last season....World soybean crushings are forecast to rise steeply by 23 Mn T from a year earlier to 352.8 Mn T in Sept/Aug 2024/25. Most of the increase will be on account of Argentina with an...

Latest OIL WORLD supply and demand estimates for all 10 major oilseeds in the MONTHLY report....

-

17 OILS & FATS

MONTHLY Mar 28

Slowdown of Consumption is Curbing the Production Deficit

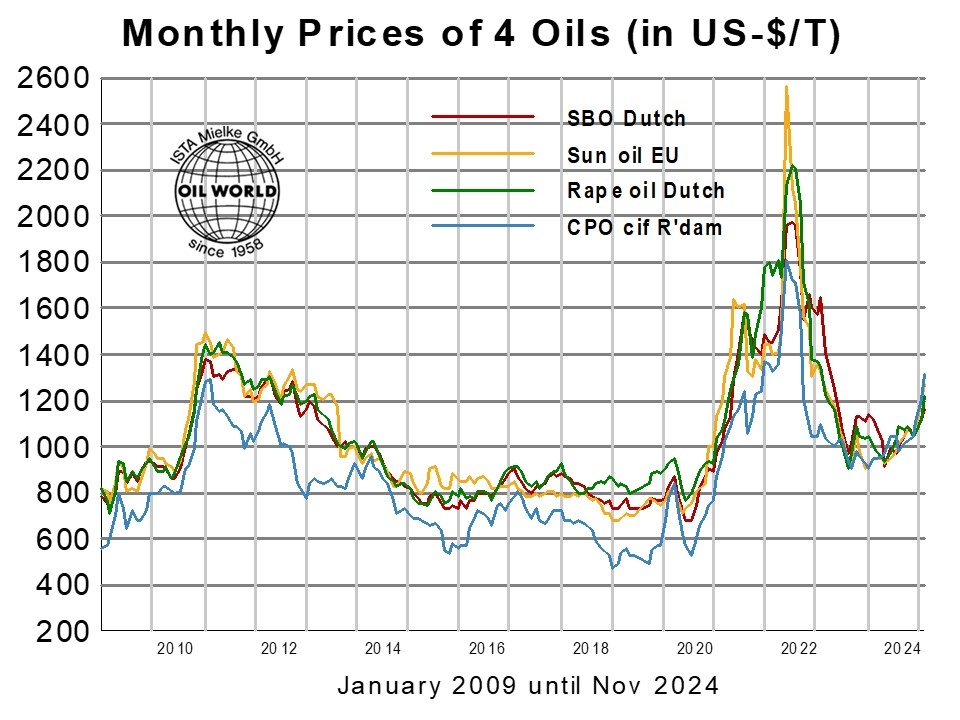

The world markets of oils and fats have been subject to massive changes in recent weeks. The lack of political support has pushed the US biofuel industry in a severe crisis of late. Eroding domestic feedstock requirements have raised US export supplies and curbed import demand, thus having significant repercussions on the world market......

These changes are seen curbing the growth in world consumption of 17 oils and fats to only about 2.1 Mn T in Oct/Sept 2024/25, against 9.3 Mn T last season and initial expectations of an increase above 3 Mn T....

-

GROUNDNUTS

WEEKLY Mar 21

Large Surplus Shaping Up in Groundnut Market

The markets of groundnuts and products will be characterized by ample to burdensome supplies in coming months, exerting price pressure. Record crops will be harvested both in Argentina and Brazil this year, coming on top of larger production in the USA and India....

World production is seen increasing to a new high of 36.4 Mn T in 2024/25 (shelled) implying an increase of 1.5 Mn T from last season...

-

LINSEED & FLAXSEED

WEEKLY Mar 14

EU Linseed Crushings Set to Decline Sharply in 2024/25

EU linseed crushings are seen falling to a 12-year low of only around 0.55 Mn T in Aug/July 2024/25), reducing output of linseed oil and expellers correspondingly. ....

EU crushers heavily depend on imports owing to insufficient domestic linseed production, with an import dependency of more than 90% on average of the 10 years to 2023/24. Trade restrictions on Russia and diminishing export supplies in Kazakhstan, viz. the two largest suppliers for the EU crush industry, have pushed EU linseed prices to a 12-month high....Latest OIL WORLD estimates in the WEEKLY...

-

CANADA

WEEKLY Mar 14

Canola Disposals Set to Decline

Escalating trade disputes with Canada’s two largest trading partners, viz. China and the US, will keep canola disposals sharply below potential in Mar/July 2025. China’s announcement of 100% import duties on Canadian canola oil and meal from March 20 onward pushed nearby canola futures (May position) to a three-month low....

While relatively tight world export supplies of vegetable oils should make it rather easy to revive import demand for Canadian canola oil in countries other than China and the US in coming months, the situation in meal is more complex....

-

INDIA

WEEKLY Mar 7

Imports Heavily Tilted from Palm Oil to Seed Oils this Season

Palm oil stocks in India plunged by roughly 0.8 Mn T in the past three months to less than 1.2 Mn T according to OIL WORLD estimates. Indian palm oil imports were clearly lower than consumption of late, enforcing a depletion of inventories...

The recent slowdown of veg. oil imports has been cushioned by relatively large vegetable oil stocks accumulated in India by the end of November 2024, which could be reduced since. However, the rapid depletion of stocks will necessitate more active purchases soon...

-

U.S.A.

WEEKLY Mar 7

Net Imports of Oils & Fats Down Sharply

The severe decline in US biodiesel production resulted in an at least temporary oversupply of soya oil on the domestic demand, reducing US prices to and even partly below the world market. While this is raising demand for US soya oil it also reduces margins for US importers, which will only be reflected in the official trade numbers with a time lag...

Combined US net imports of 17 oils & fats and tallow plummeted to only 0.56 Mn T in Jan (down 36% from a year earlier)....

--- World Market Prices in US-$/T ---

--- World Market Prices in US-$/T ---

-

- 1125 Ap

- Mar 27

- Palm olein RBD, fob Mal

-

- 560 My

- Mar 27

- Rapeseed, Europe, cif Hamburg

-

- 1009Ap

- Mar 27

- Soya oil, fob Arg

-

- 1160 Ap

- Mar 27

- Crude Palm Oil, fob Indo