-

OLIVE OIL

FLASH Dec 18

Olive Oil Prices Falling to 2-Year Low

Prices were in free fall during the past 10 weeks and established new 2-year lows. In Spain, extra virgin quality was quoted at US-$ 4138, 24% below three weeks earlier and even 56% below a year earlier...

World production of olive oil is now recovering noticeably thanks to improved weather and much better yields in Spain, Tunisia and Türkiye....

-

17 OILS & FATS

MONTHLY Dec 13

Growth of World Supplies Seen Shrinking to Only 1.9 Mn T in 2024/25

World supplies of oils and fats are clearly tightening this season, forcing our markets to look for ways to maximize production and ration demand.....

The prospective increase of global soya oil output in the vicinity of 3.8 Mn T in 2024/25 taken per se is large but is almost offset by the anticipated decline in combined production of sunflower oil and rapeseed oil by 3.6 Mn T. It remains to be seen whether global palm oil output indeed recovers from the latest setback by 2.0 Mn T this season as we currently assume.....Latest OIL WORLD supply & demand estimates in the MONTHLY of Dec 13...

-

10 OILSEEDS

MONTHLY Dec 13

World Soybean Production to Increase Sharply by 31 in 2024/25

Production of other oilseeds declining. Only 10% of the required demand-rationing in sunflowerseed has occurred in Sept/Dec 2024, which creates a big challenge in Jan/Aug 2025....

World soybean crushings have exceeded expectations in the first quarter of this season, primarily in Argentina. We have raised our estimate to 353 Mn T in Sept/Aug 2024/25. Global dependence on soya oil and meal is rising unusually sharply, mainly due to insufficient supplies of palm oil as well as of rapeseed and sunflowerseed oils and meals....

-

SOYBEANS

FLASH Dec 10

World Exports of Soybeans Declining in Nov

Soaring US soybean exports were more than offset by the seasonally declining shipments from Brazil in Nov, reducing global trade of soybeans below the year-ago level for the second consecutive month....

US soybean exports are estimated to have reached 9.5 Mn T last month, widening the year-on-year increase to 2.5 Mn T or 13% in Sept/Nov 2024 ....

-

PRICES

WEEKLY Dec 6

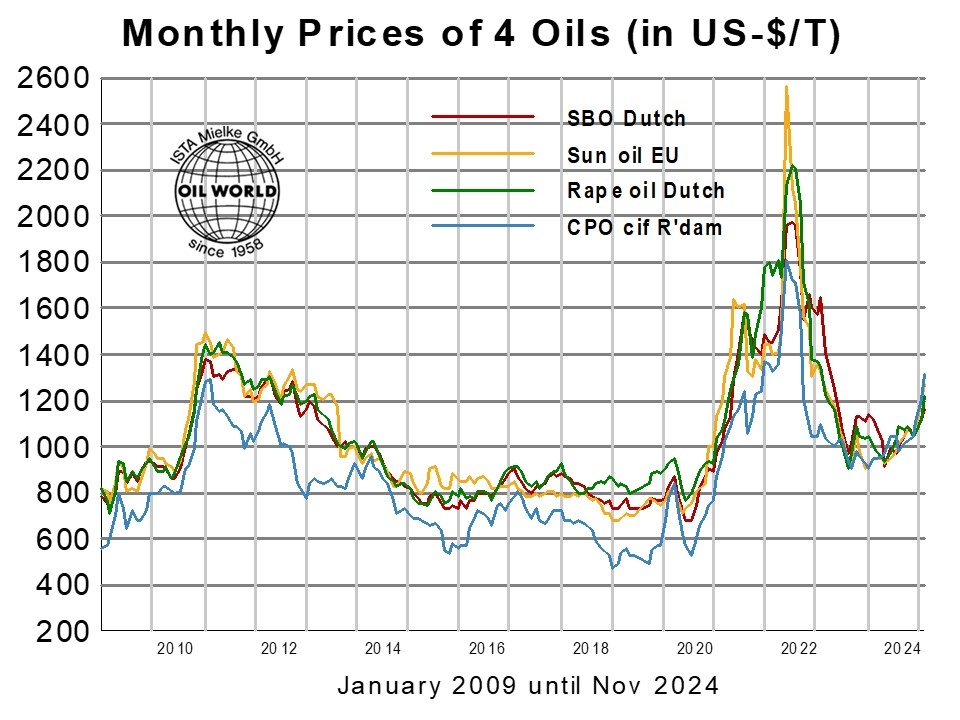

Price-driven Demand Switches to Narrow Premium of Palm Oil

The world market is still struggling to cope with the diverging fundamentals of the soya and palm oil complexes, further widening the price spread and prompting demand switches to attractively priced soya oil in key importing countries. Consumers worldwide have already reacted and stepped up purchases of soya oil in South America and even in the US. But in view of the comparatively smaller volumes, soya oil can replace the missing palm oil exports only to a certain extent. A narrowing of the price spread is therefore inevitable. We consider soya oil prices to be undervalued and also a correction in palm oil prices appears likely.... Read our full analysis in the OIL WORLD Weekly of Dec 6...

Monthly average prices of oils & fats of the past 10 years have been updated until Nov 2024 click here to order

-

SOYA MEAL

WEEKLY Dec 6

Soaring Soybean Crushings Boosting Soya Meal Exports

World exports of soya meal are accelerating. Import demand is picking up with prices having fallen to 4-year lows and supplies of sunflower & rapeseed meals declining. In Sept/Nov 2024 world exports of soya meal were boosted by about 5.0 Mn T on the year to an estimated 20.2 Mn T, driven by booming soybean crushings ...

Argentine exports more than doubled to an estimated 7.9 Mn T in Sept/Nov 2024, primarily shipped to the EU-27...

-

EU-27

WEEKLY Nov 29

European Oilseed Crushings Set to Decline Sharply in Jan/June 2025

Insufficient domestic supplies of rapeseed and sunflowerseed are likely to curb EU oilseed crushings in 2024/25....Combined setback of 2.5 Mn T in July/June 2024/25 in rapeseed and sunflowerseed processing likely to sharply reduce EU veg. oils supplies....

The necessary rationing will only be achieved via comparatively high prices. We therefore consider the setback in EU rapeseed prices on the Matif by 6% in the two weeks to Nov 28 to be only temporary. The same argument applies to rapeseed oil ...

--- World Market Prices in US-$/T ---

--- World Market Prices in US-$/T ---

-

- 1210 Ja

- Dec 12

- Palm olein RBD, fob Mal

-

- 563 Ja/F

- Dec 12

- Rapeseed, Europe, cif Hamburg

-

- 1055 Ja

- Dec 12

- Soya oil, fob Arg

-

- 332 Ja

- Dec 12

- Soya Meal, fob Arg